EITC and OSTC Programs

INDIVIDUALS & BUSINESSES: DIRECT YOUR PA TAXES WHERE THEY MATTER

The EITC program is a straightforward and impactful way to support North Catholic students. By participating, you’ll help provide scholarships that transform lives and shape future leaders.

What is EITC/OSTC?

The Educational Improvement Tax Credit (EITC) and Opportunity Scholarship Tax Credit (OSTC) programs allow individuals and businesses to receive a 90% tax credit against their Pennsylvania state tax liability when they make a donation through a Diocesan Special Purpose Entity (SPE).

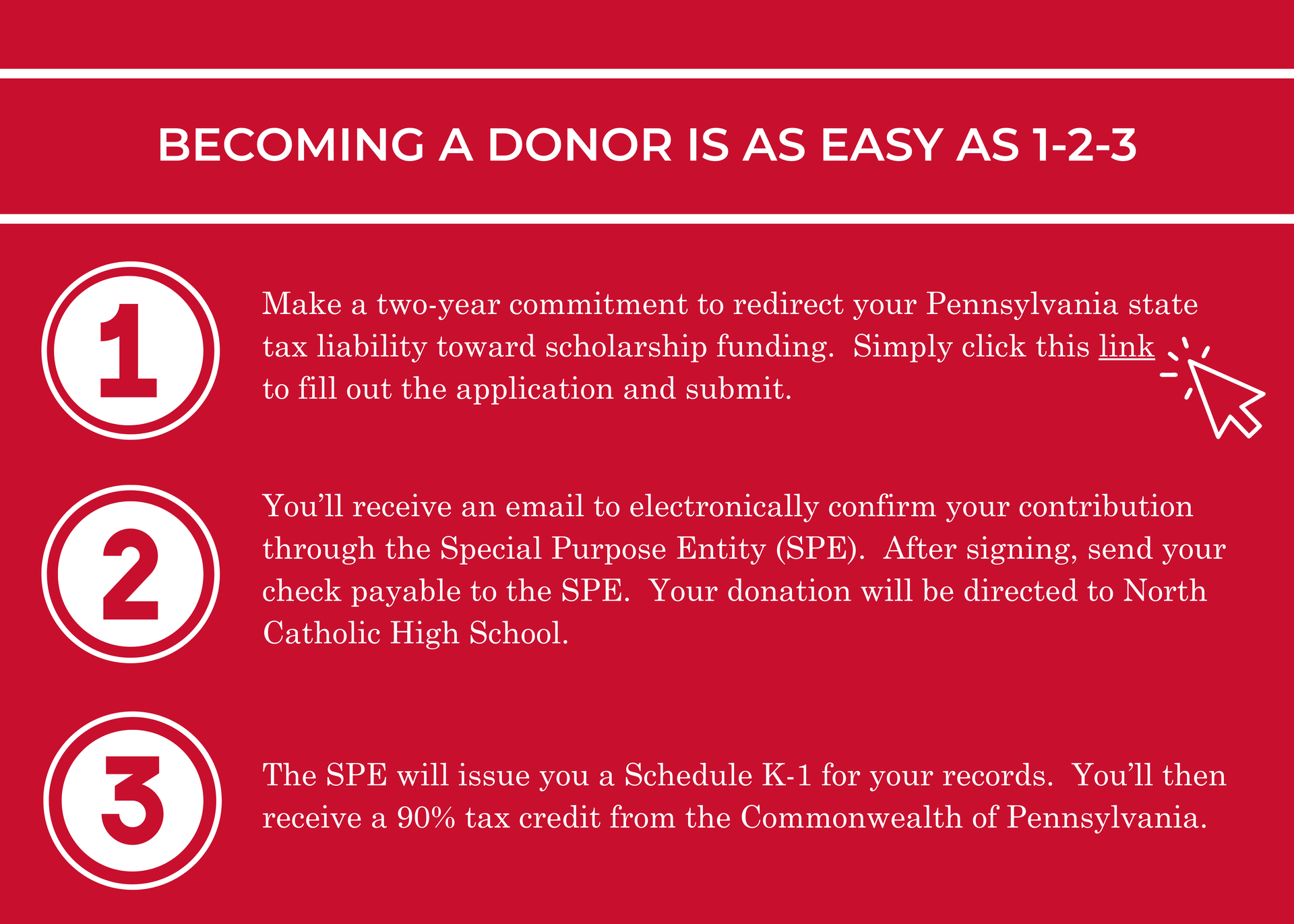

By joining the Diocesan SPE with a two-year funding commitment, donors become eligible for these tax credits. Each member receives a Schedule K-1, which reflects their share of the credit, to be applied to their PA tax liability for the year in which the donation was made.

What Taxes Can This Credit Offset?

Both individuals and businesses that pay Pennsylvania taxes may qualify for the EITC/OSTC tax credit. Eligible taxes include:

- Personal Income Tax(including for shareholders, members, or partners of S-corporations or other pass-through entities)

- Corporate Net Income Tax

- Malt Beverage Tax

- Bank and Trust Company Shares Tax

- Insurance Premiums Tax(excluding surplus lines and certain marine policies)

- Mutual Thrift Institutions Tax

- Title Insurance Company Shares Tax

- Retaliatory Fees(under Section 212 of the Insurance Company Law of 1921)

Estimate Your EITC BenefitUse this calculator to estimate your donation and tax credit under the EITC program. Step 1: Enter your estimated taxable income for the year.

Estimated PA Tax Liability (3.07%): — Step 2: Review your PA tax liability and enter your intended donation amount.

Minimum donation amount is $2,000.

Step 3: Review what North Catholic receives, your PA tax credit, and your net cost.

North Catholic Receives: —

You Receive a PA Tax Credit: —

Net Cost to You: — |

Individuals who pay Pennsylvania income taxes and businesses that are authorized to do business in Pennsylvania are eligible to participate in this program. We refer to them as “donors” below.

What tax credit programs are available in PA?

What is the maximum amount a donor can donate and receive a tax credit through EITC and OSTC?

Can a donor that received a state tax credit through EITC or OSTC still take a charitable deduction for their donation on both their state and federal tax returns?

How can a donor benefit by using the EITC/OSTC credits?

What is the timing of when we have to make our contribution?

How soon will my donation be distributed?

Can I donate directly to a student?

What is the new Federal Scholarship Tax Credit

Need Expert Help?

North Catholic works with trusted professionals who understand the Pennsylvania EITC program and can assist in managing the donation process with North Catholic from start to finish. Contact them to learn more and discuss your unique financial circumstances.